Derivatives is a contractual market which can be entered to hedge (protect) or to speculate on an underlying exposure/variable. Like we have an actual market for buying/selling an underlying such as Equity share, Currency & Commodities like Gold, Silver etc., we also have a notional/paper/contractual market which is almost 30 times the actual market and is termed as Derivatives market. The size of the market is so huge that it affects the actual portfolios of any and is growing by leaps & bounds due to certain inherent advantages in entering into Derivatives market. Knowledge about these markets is quite rare & handful and many people undertake derivative transactions without much of knowledge.

However, this growing field of knowledge should be gained by every person (whether from Finance background or not) due to its role in the financial markets & the opportunities which lie ahead.

Such derivative transactions are entered in future dates and hence arises need to form a fair view about the future of financial markets. The methods to formulate views on future trends in the financial markets and its related underlying variables are of two types namely: Fundamental Analysis & Technical Analysis.

Technical analysis is concerned with

Technical analysis is an art which involves quasi-statistical techniques and formal statistics that are used to determine the existence and strength of trends in financial time series and to identify turning points in these trends.

Technical Analysis involves the design and use of indicators to predict or formulate views about the existence, strength, or change in the trend of the financial time series in question. It also includes plotting of “support” and “resistance” levels, the breach of which is deemed to be a significant technical event. In its more complex manifestations, “patterns” are interpolated from market behavior with conclusions for future price evolution based upon the historical consequences of such patterns.

Anyone who wishes to master the craft of derivatives and technical analysis must be at least a 12th pass candidate from any stream. In fact it is a common misconception that such courses on Derivatives & Technical Charts are not suitable for non-commerce background participants. Such courses blend very well with non commerce background participants (specially from Non Medical background) and brings out various suitable openings in the live world of financial markets for them.

To obtain certification, a participant has to pass end of module exam with 70% or above marks. The foundation module exam contains classroom based interactions, virtual trading platforms based performances & Subjective, Objective and Case study based questions.

To obtain certification, a participant has to pass end of module exam with 60% or above marks. The advanced module exam contains classroom based interactions, virtual trading platforms based performances & Subjective, Objective and Case study based questions.

| Levels | Financial Derivatives & Technical Analysis-Equity | Financial Derivatives & Risk Management-Currency |

|---|---|---|

| Foundation: Concept Building | Foundation: Financial Derivatives & Technical Analysis | Foundation: Financial Derivatives & Risk Management |

| Semi Advanced: Concept Application | Advanced: CANDO & Technical Analysis | Advanced: Financial Derivatives-The Currency & rates Factor |

| Advanced: Concept Forward-thinking | Advanced: Turtle Trend Recognition System (TTRS) & Turtle Advanced Risk Management System (TARMS) | Advanced: Financial Derivatives- The Turtle Trend Risk Management |

Dates for new batch are announced over the announcement board. Please keep checking this space for latest updates. You can also

register here to receive regular updates on our courses.

The candidate who is willing to join the program will have to deposit the prescribed fee. Due to the limited size of seats available, enrollment is on first come, first serve basis. Fees can be submitted by way of Cash, Cheque or Demand draft. Details about Fee structure of each program is mentioned at their respective pages. Details about the payee is mentioned at the website link.

Failure to pay the fees shall result in the forfeiture of the seat and the seat shall be allotted to the next candidate.

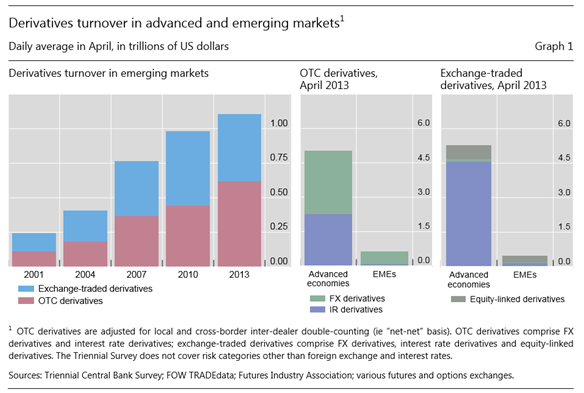

Derivatives market can be traded/entered upon at two counters namely:

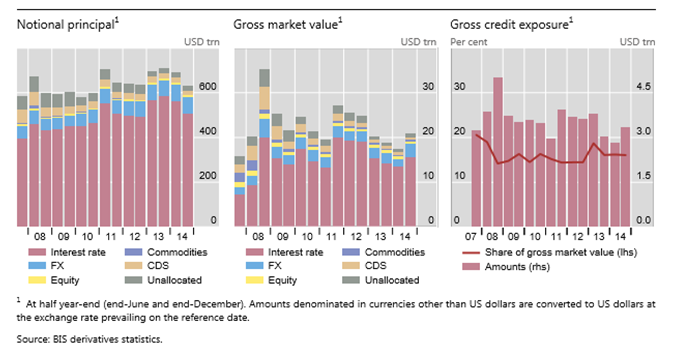

Interest rate & Foreign Exchange derivatives

From the above available data, it can be observed as follows:

It can be seen from the data above that

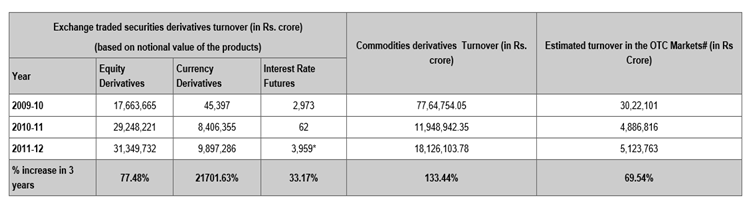

The turnover in various derivative contracts over the past three years across the segments is given below.